Why understanding the EB-5 Investment Amount can increase your success rate

Spend for Your Future: Comprehending the EB-5 Visa and Visa Process

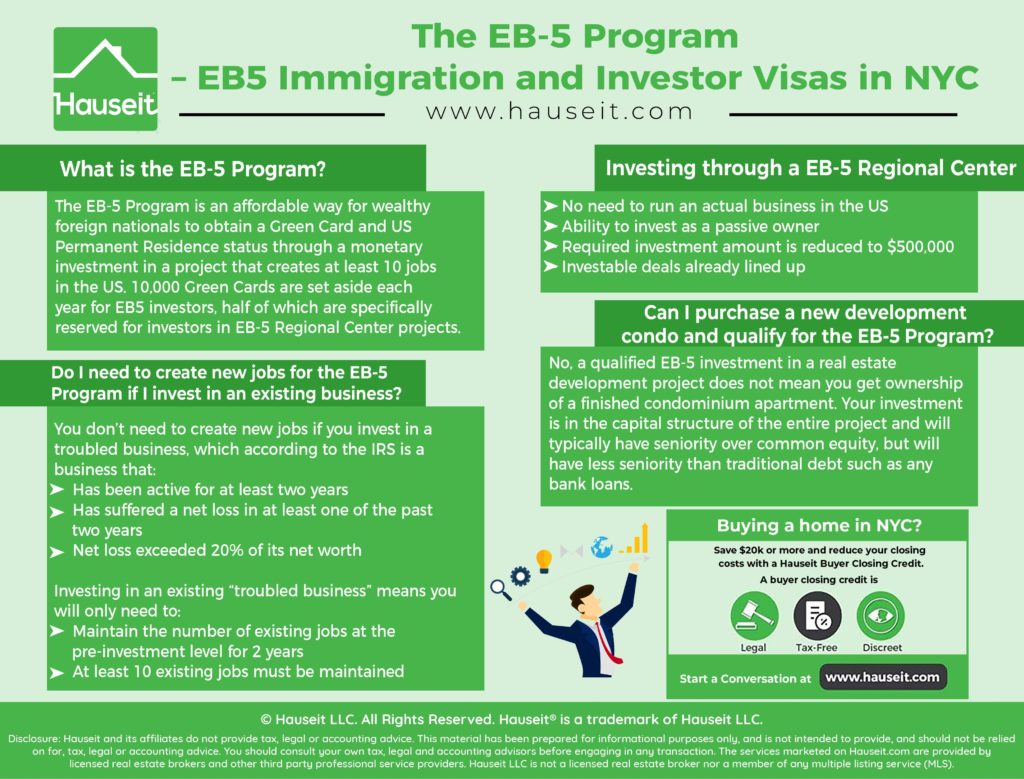

The EB-5 Visa program presents a compelling method for international financiers seeking united state permanent residency through calculated investments that stimulate task production - EB-5 Visa by Investment. With a minimum investment threshold of $800,000, this program not only promotes the investor's migration procedure but also contributes to the more comprehensive economic landscape. Steering with the details of eligibility demands, financial investment choices, and the application timeline can be complex. Recognizing these aspects is vital for making informed choices that could significantly influence your future, yet lots of prospective applicants stay unaware of the nuances entailed

Review of the EB-5 Visa

The EB-5 Visa program offers an one-of-a-kind path for international financiers looking for permanent residency in the USA. Established under the Immigration Act of 1990, this program intends to stimulate the U.S. EB-5. economy with funding financial investment and job creation. Investors that qualify can obtain a visa for themselves and their prompt member of the family by investing a minimum of $1 million in a brand-new company or $500,000 in a targeted employment location, which is defined as a backwoods or one with high unemployment

The EB-5 Visa not only facilitates access to long-term residency but likewise permits capitalists to join a vivid market. By preserving or creating at the very least 10 permanent jobs for united state workers, the capitalist can meet one of the important requirements of the program (EB-5 Visa by Investment). The investment can be made directly in a service or with a designated Regional Center, which handles the investment process and work production in support of the investor

Qualification Demands

To receive the EB-5 Visa, financiers need to satisfy particular certifications and adhere to suggested financial investment quantities. These requirements are developed to ensure that candidates contribute considerably to the U. EB-5 Investment Amount.S. economic situation while additionally boosting work development. Comprehending these qualification requirements is crucial for possible investors seeking irreversible residency with the EB-5 program

Capitalist Accreditations

Capitalist certifications for the EB-5 visa program are important in determining qualification for involvement in this path to long-term residency in the USA. To qualify, a capitalist should be a foreign nationwide who agrees to buy a brand-new commercial enterprise that develops tasks for U.S. employees.

The investor needs to show that they have the requisite funding, which can be sourced from legal means. Additionally, the financier's funds must be at threat, implying they can not be ensured a return on their financial investment. This standard highlights the demand for dedication to the venture.

Additionally, the investor must be proactively entailed in the management of business or have a policy-making role, ensuring that they are adding to the success of the venture. Significantly, the capitalist needs to likewise meet the minimal age demand of 21 years.

Last but not least, it is necessary for financiers to confirm that their financial investment lines up with the EB-5 program's geographic and financial criteria, specifically if purchasing a targeted employment area (TEA), which may offer specific benefits. Understanding these qualifications is crucial to navigating the EB-5 visa procedure efficiently.

Financial Investment Amounts Required

Eligibility for the EB-5 visa program hinges dramatically on the investment quantities needed, which are readied to ensure that international financiers add meaningfully to the united state economy. As of the current standards, the minimal investment called for is $1 million. This amount is lowered to $800,000 if the investment is made in a targeted employment area (TEA), which is normally a country location or one with high joblessness prices.

These financial investment amounts are essential as they are made to boost work development and financial growth within the USA. Each EB-5 capitalist is needed to show that their investment will produce or protect a minimum of ten full time work for united state workers within two years of the financier's admission to the nation.

Furthermore, it is necessary for capitalists to carry out complete due persistance when selecting a project, as the possibility for task development and the overall viability of the investment directly impact the success of their application. Understanding these financial requirements is a basic action in steering through the EB-5 visa procedure and protecting a pathway to long-term residency in the united state

Investment Options

When considering financial investment choices for the EB-5 program, it is important to comprehend the various kinds of investments offered. Investors have to likewise examine the connected dangers, guaranteeing an educated choice that lines up with their financial goals. This conversation will certainly check out both the kinds of financial investments and effective threat evaluation strategies.

Kinds of Investments

The landscape of EB-5 investments supplies a range of options tailored to fulfill the diverse objectives of potential capitalists. At its core, the EB-5 program allows people to purchase brand-new companies that will maintain or create at the very least ten permanent jobs for certifying united state workers.

Additionally, investors can select straight investments in their very own service ventures. This route calls for a more hands-on strategy and direct involvement in handling the enterprise, enabling better control over the investment.

Additionally, capitalists can consider conventional investments in approved tasks that meet the EB-5 standards. These can vary from manufacturing facilities to friendliness developments, each with one-of-a-kind offerings and potential returns.

Eventually, the choice of investment must straighten with the financier's financial goals, danger tolerance, and degree of desired involvement, allowing them to accomplish visa requirements while seeking growth opportunities in the U.S. economic situation.

Danger Evaluation Techniques

Effective threat examination approaches are vital for EB-5 capitalists looking for to browse the complexities of investment options. Reviewing the practicality of an investment needs a thorough understanding of both the economic landscape and the certain task concerned. navigate to this website Capitalists should start by carrying out due persistance on the Regional Facility or task enroller, inspecting their performance history, economic security, and compliance with EB-5 policies.

It is crucial to examine the market problems appropriate to the investment. Evaluating the regional economic situation, market patterns, and competition can provide insights into possible dangers and returns. Capitalists ought to also take into consideration the job's task development potential, as this is a key demand for EB-5 visa qualification.

Diversity can reduce threats related to individual financial investments. By spreading capital across numerous jobs or industries, capitalists can reduce the influence of a solitary investment's underperformance. Involving with skilled legal and financial consultants can aid navigate complicated regulations and determine red flags that might not be right away obvious.

The Regional Center Program

Designed to boost economic development and work creation in targeted locations, the Regional Center Program is a critical part of the EB-5 visa campaign. Established by the U.S. Citizenship and Immigration Solutions (USCIS), this program enables capitalists to pool their resources right into marked Regional Centers, which are entities approved to promote investment projects that satisfy certain financial criteria.

The primary objective of the program is to produce or maintain at the very least 10 full time work for united state workers per financier. Regional Centers typically concentrate on economically distressed areas, consequently boosting regional economies while supplying a pathway to long-term residency for foreign investors. By spending a minimum of $800,000 in a targeted work location (TEA) or $1,050,000 in a non-TEA, capitalists can add to varied jobs, including real estate developments, framework renovations, and various other service ventures.

Furthermore, financial investments with Regional Centers commonly include a minimized burden of direct work development requirements, as the task development can be indirect or induced. This adaptability makes the Regional Facility Program an appealing choice for numerous international nationals looking for to obtain an U.S. visa through investment.

Application Process

Guiding with the application process for an EB-5 visa involves numerous crucial actions that prospective capitalists have to follow to guarantee conformity with U.S. migration guidelines. The very first step is to recognize an ideal EB-5 project, preferably via an assigned local center, ensuring it meets the financial investment and task production demands.

When a project is chosen, capitalists need to prepare the required documentation, that includes evidence of the source of funds, a detailed business plan, and lawful agreements associated with the financial investment. This stage is critical as it develops the authenticity of the investment and its alignment with EB-5 requirements.

Adhering to document prep work, investors should complete Form I-526, the Immigrant Application by Alien Capitalist. This form calls for complete information regarding the financial investment and the investor's qualifications. When submitted, the request undergoes evaluation by united state Citizenship and Migration Provider (USCIS)

Upon authorization of the I-526 request, investors can proceed to request their conditional visa. This phase involves sending added forms and attending an interview, where the financier needs to demonstrate their intent to accomplish the financial investment requirements and create the requisite work. Each of these steps is crucial for an effective EB-5 visa.

Timeline and Processing

Steering the timeline and processing for the EB-5 visa can be complicated, as different aspects affect the duration of each stage. Typically, the process begins with the entry of Form I-526, the Immigrant Petition by Alien Investor. This initial application can take anywhere from 6 months to over 2 years for authorization, depending on the solution center's workload and the specifics of the investment project.

Once the I-526 application is accepted, capitalists might use for conditional long-term residency via Type I-485, or if outside the U.S., they may go with consular handling. This action can take an added six months to a year. Upon receiving conditional residency, investors must fulfill the financial investment and work development demands within the two-year period.

Benefits of the EB-5 Visa

The EB-5 visa supplies a path to permanent residency for international financiers, providing them with significant advantages past simply immigration (Targeted Employment Area TEA). One of the main benefits is the chance for investors and their instant member of the family to acquire united state permits, approving them the right to live, function, and research in the USA without restrictions

Additionally, the EB-5 program promotes job creation and economic growth in the united state, as it needs financiers to produce or maintain at the very least 10 permanent jobs for American workers. This not just profits the economy but likewise improves the financier's neighborhood standing.

The EB-5 visa is unique in that it does not call for a details company background or prior experience in the United state market, enabling a wider range of people to get involved. Financiers can also take pleasure in a fairly expedited path to citizenship after keeping their long-term residency for five years.

Frequently Asked Questions

Can I Include My Family Members Members in My EB-5 Application?

Yes, you can include immediate relative-- such as your spouse and single kids under 21-- in your EB-5 application. This incorporation enables them to take advantage of the immigrant financier program alongside you.

What Takes place if My Financial Investment Fails?

If your financial investment fails, you may not meet the EB-5 program needs, resulting in the possible loss of your visa eligibility. It's important to carry out extensive due persistance before investing to mitigate threats effectively.

Exist Age Restrictions for EB-5 Investors?

There are no specific age restrictions for EB-5 capitalists. Candidates must demonstrate that they satisfy the financial investment requirements and abide with guidelines, regardless of their age, making sure qualification for the visa process.

Can I Use for Citizenship After Obtaining the Visa?

Yes, after getting a visa, you may make an application for U.S. citizenship with naturalization. Generally, you need to keep irreversible resident status for at the very least five years, showing excellent moral personality and meeting various other requirements.

Is There a Limit on the Number of EB-5 Visas Issued Each Year?

Yes, there is an annual restriction on EB-5 visas. Currently, the program designates 10,000 visas each , with added arrangements for household participants of financiers, which can impact general availability and processing times.

The EB-5 Visa program offers an engaging method for foreign capitalists seeking United state permanent residency with strategic investments that stimulate work creation. To certify for the EB-5 Visa, capitalists should meet certain qualifications and adhere to suggested financial investment quantities - EB-5. It is essential for financiers to verify that their financial investment straightens with the EB-5 program's geographic and economic requirements, especially if investing in a targeted work area (TEA), which might provide particular advantages. Eligibility for the EB-5 visa program hinges significantly on the financial investment quantities called for, which are established to guarantee that international capitalists contribute meaningfully to the U.S. economic climate. Complying with document preparation, financiers need to finish Kind I-526, the Immigrant Petition by Alien Financier